What is customer lifetime value (CLTV)?

Customer lifetime value measures how much customers are worth for the duration of their relationship with your business.

Why does CLTV Matter?

There are several reasons that customer life-time value matters.

First, understanding lifetime value helps you determine how much your business can afford to spend to acquire new customers and to retain existing customers.

Second, customer life-time value tends to vary by customer segment. Understanding which segments are most and least profitable helps you identify which types of customers to nurture and, in some cases, which customers to “fire.”

Third, analyzing the different parts that make up customer lifetime value will help you identify which levers are most important in improving customer profitability. For example, if you find a significant drop-off between a customer making a first purchase and a second purchase, you might focus on increasing the number of customers who make a second purchase.

The bottom line is that understanding your customers’ lifetime value is a critical underpinning of growing and maintaining a healthy and profitable business.

How do I calculate customer life-time value (CLTV)?

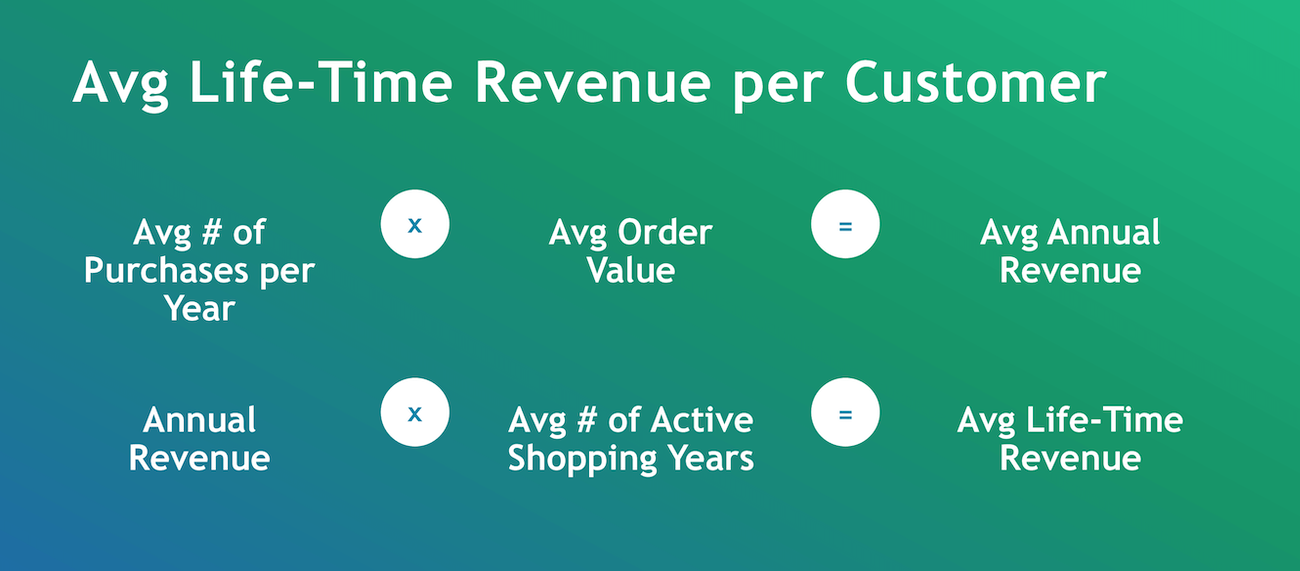

Let’s start with the basic equation.

You will need to determine a period of time you are going to use as your customers’ lifetime. That means how long your customer will remain an active customer. For this exercise, let’s assume a lifetime of three years. An analysis of your business’ customer cohorts will get you a more precise answer, but for now, let’s use three years as an example. Here is what you will need to know:

If you want to understand your gross margin per customer, you’d adjust the formula this way.

Now we need to look at the cost of acquisition.

Why do I need to look at the cost of customer acquisition?

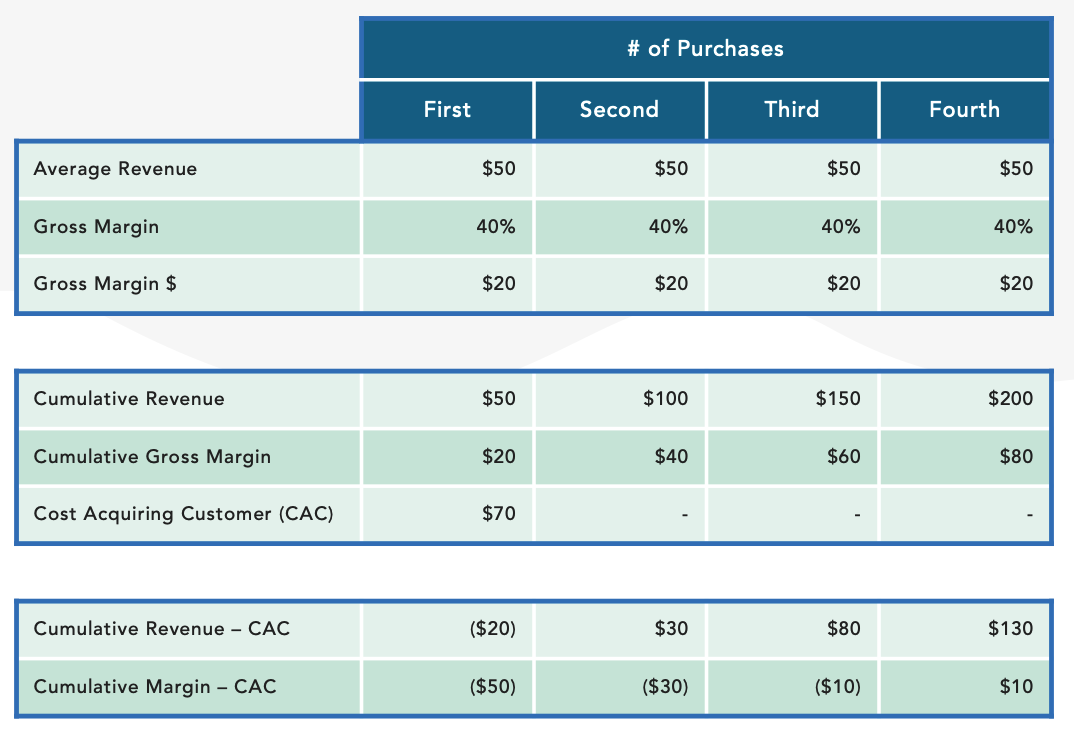

For most businesses, the cost of acquiring a customer is a significant expense. Rarely do businesses generate enough revenue and margin in the first purchase to recover the cost of acquiring the customer. Backing out the cost of acquisition gives your business a much more accurate view of your overall profitability.

I don’t have a fancy analytics team; how do I calculate the cost of customer acquisition?

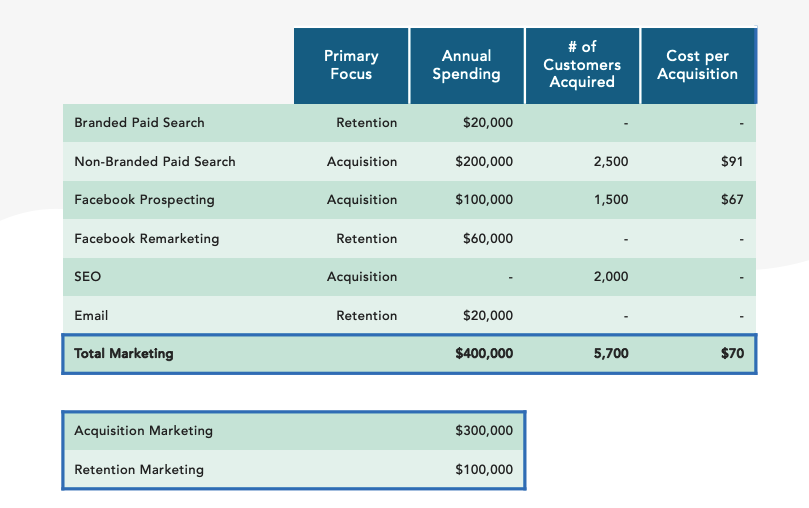

The most straightforward way to estimate customer acquisition cost is to assign a role to each marketing channel. In other words, a marketing channel is labeled as either acquisition or retention. The costs associated with that marketing channel are then applied to either acquisition or retention. We have an example below for you to follow. The numbers we are using are annual, but you can use quarterly or monthly numbers if your business has a lot of seasonality or prefer a greater precision level.

In this case, the blended cost of acquisition is $70 per customer. The business is spending $300,000 a year on acquisition and $100,000 a year on retention marketing.

Let’s wrap up the customer lifetime value for this business.

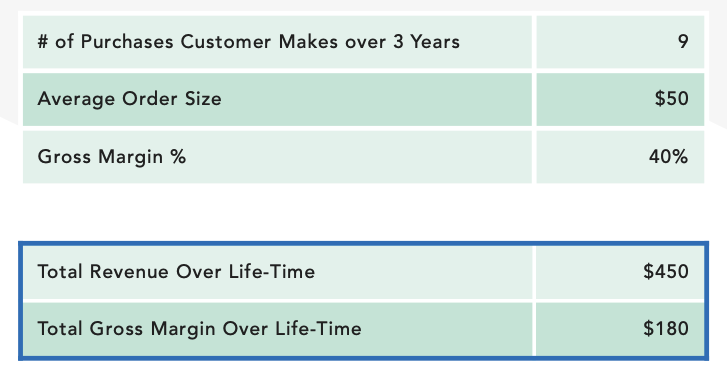

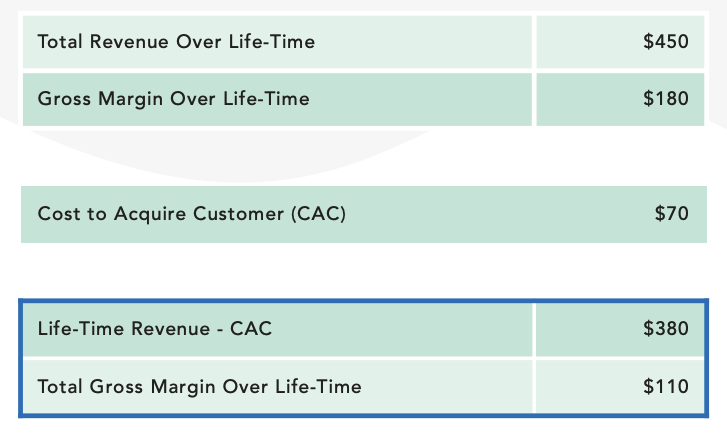

Assume a scenario where customers make 9 purchases over a 3-year period, each one averaging $50. That means the customer generates $450 over the lifetime. With a 40% margin, that is equivalent to $180 in gross margin.

To calculate the life-time revenue and margin, you would do the following:

The average lifetime revenue after CAC is $380, and the margin is $110. It’s important to note that this business does not break-even on acquisition until the fourth purchase. This is what makes customer segmentation and customer nurture programs so important. That is not to say that every business will break-even only on the fourth purchase, but most businesses do NOT break-even on the first purchase, and it’s important to understand when they do so that you can maximize your business’ productivity.

An example of the cumulative revenue and margin for the first four purchases is below: